Special Report Technology roadmap to drive growth of SEMs and middle-standing enterpr…

페이지 정보

작성자 최고관리자 댓글 0건 조회 4,069회 작성일 19-05-29 11:39본문

Ⅰ. Overview

1. Definition & Background

‘IT convergence equipment’ refers to the marine equipment used to collect, integrate, exchange, express and analyze the marine information on land-based locations and vessels electronically to improve the navigation and related services with an aim to protect marine environment and ensure safety and security at sea during the navigation of ship from one port to another port.

The International Maritime Organization(IMO) decided to adopt the ‘e-Navigation’ applying the ICT(Information and Communication Technology) to existing ship navigation management system in 2006 to reduce maritime accidents caused by human factors. Currently, the IMO is developing the maritime communication technology based on convergence between shipbuilding technology and IT(Information Technology), technology for integration of information related to land-based locations and vessels, and e-Navigation for development of service and service delivery technology.

The ‘e-Navigation’ is a technology that brings about drastic improvement of process and productivity at the production sites of shipbuilding & offshore industry, takes the ship/offshore plant functions and value to the next advanced level, and creates related new services based on development of new technologies resulting from combination of IT with traditional shipbuilding & offshore technologies.

By applying the IT, this new technology will further increase productivity underpinned by streamlined designing and construction processes in shipbuilding & offshore industry and enable creation of high-value-added based on advanced functions of ship and offshore systems, electronic and communication equipments installed on vessels and plants while realizing high performance of the equipment mounted on small and medium-sized vessels and leisure vessels.

2. Scope

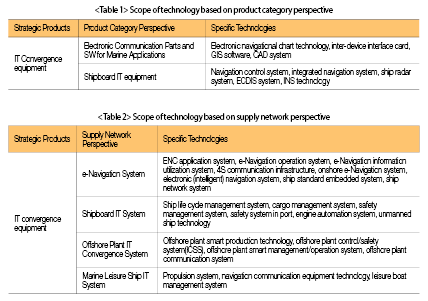

(1) Perspective related to product categorization

In the shipbuilding IT segment, equipment can be classified into marine electronic communication components, shipboard IT equipment, digital ship system and SW kernel and algorithm for shipyards that integrate those IT equipment, ship design and production support module, and digital shipbuilding system, such as PLM, for integrated management. The market for those products has remained single market and relatively small and is determined by the preference of ship owners and shipyards, and as a result, has been dominated by a few overseas companies.

(2) Perspective related to supply network

The technology for IT convergence equipment can be classified at large into e-Navigation system, offshore plant, and IT convergence equipment/material technology for marine applications.

Ⅱ. Analysis of Industrial Environment

1. Characteristics and structure of industry

(1) Characteristics of industry

The shipbuilding IT convergence represents an industry manufacturing the products that either perform or enable the collection, processing, display of the information necessary for functions and electronic communication of vessels, along with the products that perform or enable collection(sensing), processing, display(computing), transmission/receipt(networking) and controlling(actuating) of internal and external information electronically.

Products for shipbuilding & offshore applications include commercial vessels, special purpose vessels such as offshore support vessels, warships, vessels operating in Polar region, fishing boats, and equipment of various kinds. Commercial vessels used in shipping industry are classified into the categories of crude oil tankers, containerships, bulk carriers, LNG carriers, chemical tankers, PCTCs(Pure Car Truck Carriers), passenger ships, etc., depending on the type and characteristics of cargo. In this industry, it is essential to apply advanced IT to the design, production and management for greater competitiveness with cost reduction and automation of high quality vessel production.

Domestic IT convergence equipment/material industry has the strengths including extensive experience in shipbuilding, abundant technical manpower, and advanced downstream industry. However, the industry still lags behind the shipbuilding industry in terms of technical level of equipment for key and high-value-added ship applications and has seen the selection of equipment being determined by the preference of ship owners. Internationally, domestic industry can seize opportunity to establish a leading position in the field of e-Navigation which currently remains at inchoate stage while it is likely to be confronted with strategic challenge from China’s cheap labor and Japan’s technological strength. Korea’ shipbuilding and IT industry, which have taken top spot worldwide, stand out for the synergy effect created by convergence while both industries have different structure and pattern which complicates the convergence.

The shipbuilding industry, a custom-built industry that builds vessels upon orders placed by ship owners, has seen greater synergic effect created by adoption and convergence of IT, compared to the synergic effect resulting from installation of IT equipment on board vessels. As there is no statistical data on that, it would be necessary to examine the effect of ICT convergence constantly. The industry has witnessed new navigation communication equipment rolled out in the market according to plan to realize IMO e-Navigation, integration of ship information in the midst of integration of equipment into networks, robust IT services bolstered by 4S communication and spread of shipboard internet system, adoption of onshore e-Navigation, New GMDSS, etc., which shows the trends towards eco-friendly ship environment and overall shift in ship operation paradigm.

Technologies applicable to vessels are being developed in various segments, such as the technology to cope with offshore environmental regulations, energy-saving technology, ship stability improvement technology, etc. In particular, there has been convergence with cutting-edge technologies to build high performance vessel, intelligent vessels and offshore structures.

In addition, computerization, using the ship design programs, has gathered pace drastically on the back of rapid advancement of related industries such as IT and computer technology. Also, product/construction process standardization for ship model, outfitting, etc., is being pushed forward actively to improve productivity and reduce costs.

The shipbuilding & offshore industry, a traditional labor-intensive industry, has been transformed into a high-value-added industry based on advancement of shipyard design and production system and productivity improvement which have been brought about by convergence with IT.

The United States and Europe, which have the leading technologies in engineering and designing of vessels and offshore structures, are reinforcing technical barriers to preclude erosion of their technological dominance. Nonetheless, Korean shipbuilding & offshore industry are overcoming the barriers and likely to acquire differentiated technologies by combining the IT with their shipbuilding technologies. As the IT is being incorporated vigorously into the equipment for ship and offshore structures, the value-added from production has drastically increased as offshore structures have become more intelligent and automated, providing highly advanced performance and creating high-value-added.

As the IT is finding wide-ranging applications to offshore industry, a variety of equipment in vessels and offshore plants has become increasingly connected to networks. As a result, there has been a shift from simply automated equipment towards networkable equipment, which has led to a rising demand for equipment connectable to ship network and greater importance of higher value-added IT service industry.

(2) Structure of industry

Considering the costs to be incurred from installing the IT convergence equipment on board vessels conforming to requirements of international conventions over the next decade, the indirect market is expected to be worth approximately KRW 145 trillion over the next 10 years in light of the chain effect from upstream and downstream segments. Chain effect in upstream segment is expected, including the growth in industries related to electricity/electronics, IT and S/W for installation of IT convergence equipment on board the vessels and on land. Moreover, chain effect is also expected to arise in downstream segments, including the industries related to internet and contents necessary for providing information services, along with communication industry(wireless, satellite), as a result of the IT convergence equipment installation. IT convergence equipment is considered to have the market potential similar to that of telematics and IPTV(Internet Protocol TV) which are being promoted as the growth engines for the nation.

The demand for marine broadband mobile satellite communication is expected to rise when shipyards portfolio of vessels, currently made up primarily of LNG carriers, FPSO, containerships, and tankers, consists mainly of LNG carriers, drillships, FPSO, including high-value-added cruise ships.

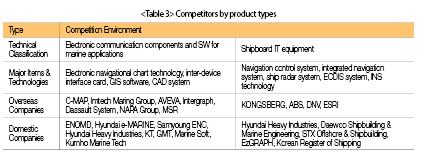

2. Environment for Competition

Emerging markets are showing rapid growth and new industries are emerging. New and alternative demand for vessels is on the rise amid the increase in international shipping volume while new demand is rising for offshore plants on the back of the increasing energy prices. However, international competition is intensifying as the emerging countries, such as China, India and Brazil, are trailing closely behind. Despite expansion of the market for key equipment used to develop offshore energy resources and related engineering market, domestic technologies have been limited to production and construction. Therefore, domestic industries would need to acquire key technologies for design, production and construction and map out strategies for differentiation from existing technologies. Particularly, new market has been created for services associated with vessels and offshore plants amid the increased convergence with IT. To support that, there has been a growing need for development of new technologies.

Meanwhile, later comers in the shipbuilding market, such as China, India, and Brazil, are protecting their domestic shipbuilding & offshore industry as key strategic industry at a policy level. In addition, Japan and European countries, the traditional shipbuilding powerhouses, are also enforcing the policies designed to underpin their domestic shipbuilding & offshore industry that includes the cruise ship and high-value-added marine equipment segments. Ship owners and major offshore oil companies are further building up the strengths in their technologies for shipbuilding and offshore-related designing and products as major basis for certification and international standards through the American Petroleum Institute(API), International Maritime Organization(IMO), International Association of Classification(IACS). European countries are vigorously creating the standards and concepts related to IMO e-Navigation to maintain their leading position in the marine equipment market.

In the shipbuilding IT sector, the digital shipbuilding system can be classified into categories of the electronic communication parts and software for marine applications, shipboard IT equipment, digital ship system integrating the shipboard equipment, SW kernel and algorithm for shipyards, ship design and production support module, and PLM for integrated management. However, the market for those products has remained single market and relatively small and is determined by the preference of ship owners and shipyards, and consequently, has been dominated by a few overseas companies. Recently, Korean IT shipbuilding companies are pushing ahead with technology development to prevent direct and indirect outflow of technologies related to ship/offshore structure production and designing and maintain technical gap with late comers so as to sharpen their global competitive edge, but still have to overcome technical gap with developed countries. As the green ship and e-Navigation initiatives are currently being led by the International Maritime Organization(IMO), etc., now is the ideal time for Korean companies to make entry into the shipbuilding IT sector by leveraging the advanced IT of Korea. Despite the central government’s policy that aims to foster marine leisure industry and local governments’ plan to build marina, Korean industry with still weak competitiveness is very likely to see foreign products dominate the market, thus hindering the growth of Korean leisure industry.

Marine equipment currently accounts for 55-65%. When the e-Navigation system is put in place by 2019, the share of IT equipment in shipbuilding cost is expected to rise to about 20% from current 7-8% for containership, 5% for tankers and 10% for LNG carriers.

Although major ports are equipped with traditional VTS systems made by foreign companies, the introduction of intelligent traffic control system has been mulled over which can help mitigate the work load of controller and reduce marine accidents. The Ministry of Oceans and Fisheries(MOF) is proceeding with technology development for localization of next-generation VTS system applying various standard technologies of e-Navigation. In light of that, a new market is likely to be created to replace existing VTS systems. The ratio of local components has reached 90% in domestic shipbuilding and marine equipment industries. The share of imported components has remained about 10%, which are however mostly key components for the e-Navigation. Particularly, Korean industries are expected to have the heaviest reliance on imported shipboard electronic IT-convergence equipment.

3. Environment for upstream and downstream industries

The IT industry has served as a growth engine for Korean economy based on high-speed Internet and wireless communication infrastructure since 1990s, playing an important role in promoting the stability and growth of the nation’s macro economy that covers the aspects of production, employment, trade balance improvement and price decline. However, competition from globalization, such as the rise of China, is intensifying. As the industry reaches maturity, structural changes have taken place, including the slowdown in growth across the IT industry.

This environmental change highlighted the necessity for shaping a new strategy along with review of the previous IT industry development strategy. In particular, ‘convergence’ has emerged for a giant leap forward in the IT industry.

As the IT functions are integrated and internalized into traditional industries, such as shipbuilding, machinery, automobiles, and textiles, based on IT convergence, the role of IT source technology that helps increase the value added and build up competitiveness of existing industries has been increasingly emphasized.

As a means to overcome the constraints hindering the growth of IT and non-IT industries and to increase value-added, the alternative means for creation of new industries or convergence between individual industries have been needed. As the IT is being used as a common infrastructure technology, the IT has been placed at the heart of convergence. In addition, the parts and materials for convergence among IT-oriented industries have become increasingly important.

The convergence between shipbuilding industry and IT has been thrust into limelight as it can pave the way for creation of new high value-added through combination with different technologies. In particular, the convergence of IT industry, which drives the advancement of technologies in various fields such as domestic shipbuilding industry with world’s leading technologies, mobile phone penetration rate, high-speed internet penetration rate, memory semiconductor production, etc., is expected to play a positive role in cementing the world’s leadership position of both IT industry and shipbuilding industry. However, the IT sector in the shipbuilding industry currently has shown a very low localization rate for core technologies such as high-value-added equipment and ship communication device technology. The IT convergence technology in shipbuilding industry is making very slow progress because it focuses on improving productivity and solving short-term difficulties rather than developing next-generation technologies. Technically, both shipbuilding and IT technologies of Korea have reached world-class levels, but the level of IT shipbuilding convergence technology still remains low. The convergence is taking on an added importance as it is characterized by the innovative and far-reaching convergence that occurs rapidly in a wide range of areas, unlike the existing gradual convergence. To promote the IT convergence equipment technology, it would be necessary to acquire frequency resources for shipboard communication, expand application of wireless communication technology, and develop various devices for shipboard wireless communication. As it is particularly important to acquire frequency resources for shipboard communication with standardization being pushed forward through international standards organizations, it would be necessary to apply the experience, gained from international standardization of CDMA, WiBro, DMB, etc., to the field of shipbuilding industry.

Ⅲ. Analysis of Market Environment

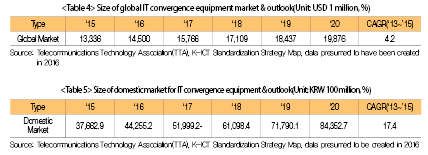

1. Global market

The global IT convergence equipment market in the shipbuilding industry is expected to increase gradually and reach KRW 280 trillion in cumulative terms from 2017 to 2027. The portfolio of vessels, currently comprised of LNG carriers, FPSOs, containerships, tankers, etc., is expected to include high value-added cruise ships and drillship, and in such a case, the demand for marine broadband mobile satellite communication is likely to increase. According to the “Action Plan for e-Navigation Development Strategy” being developed by the IMO, the future ship navigation is expected to undergo a new paradigm that vessels operate in conjunction with the land, unlike current ship-based navigation. Therefore, the market for new intelligent IT ships that accommodate to e-Navigation environment is expected to grow rapidly.

According to the IEC TC 80 report, the share of navigation communication equipment has reached 6% of ship price. Global market for large commercial vessels is currently worth USD 1.7 billion while global market for fishing boats and leisure vessels are worth USD 500 million and USD 1.3 billion, respectively. The ship navigation communication equipment industry is a high-value-added industry that is expected to show constant growth. The market for ship navigation communication equipment is projected to grow from about KRW 26 trillion in 2013 to approximately KRW 33 trillion in 2018 with an average annual growth rate of 2.4%.

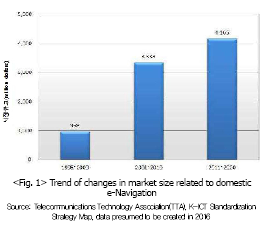

2. Domestic market

Domestic IT convergence equipment market has reached about KRW 1 trillion from 1996 to 2000 and KRW 3.6 trillion from 2001 to 2010, and is expected to grow to about KRW 4.4 trillion for the 10 years from 2011. Marine equipment account for 55-65% of shipbuilding costs. Meanwhile, the IT marine equipment cost comprises 7-8% in containership, 5% in tanker, and 10% in LNG carrier. When e-Navigation is put in place by 2019, the share of IT marine equipment cost is expected to increase gradually to 20%.

The ratio of local components has reached 90% in domestic shipbuilding and marine equipment industries. The share of imported components has remained about 10%, which are however mostly key components for the e-Navigation. Particularly, Korean industries have the heaviest reliance on imported shipboard electronic IT-convergence equipment. Domestic industry need to proceed with development of electronic IT-convergence equipments for ship navigation, communication and control, etc., urgently by developing indigenous technologies and taking its current technology to the next advanced level so as to capture larger share of global market.

Ⅳ. Analysis on technological environment

1. Trend of technology development

(1) IT technologies applied to shipyards

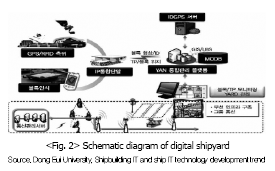

As ships are so large that any full-scale test with real ships is impracticable, efforts are being made to increase productivity in ship designing and construction processes by applying IT to shipbuilding. Finally, there is a need to realize digital shipyards that can apply the IT to simulate shipbuilding processes virtually to identify problems in advance. Currently, Korean shipyards are developing basic technology to increase productivity of shipyards by more than 8% by applying the IT such as VR design technology and simulation-based ship production technology, and to reduce carbon emissions during shipbuilding processes. Korean shipyards aim to apply IT technology to ship design and production as much as possible to raise productivity of shipyards by more than 10% and maintain their unrivalled competitiveness in global shipbuilding industry while developing the process energy management and carbon reduction technologies applicable to shipbuilding processes in order to help resolve environment problems which the world is confronted with.

(2) Standardization of e-Navigation system

The International Maritime Organization(IMO) has introduced a new concept called e-Navigation system to prevent environmental pollution in the ocean, ensure the safety of ships and increase the efficiency of navigation, and is proceeding with related standardization. At present, Korean shipyards need to develop the technology necessary for coping actively with e-Navigation standardization being promoted by IMO while standardizing their domestic technologies. Studies have been conducted on related technology, led by domestic research institutes and the National Oceanographic Research Institute. European countries and the United States have secured the world’s leading key technologies in connection with e-Navigation ad have already moved forward with commercialization.

Technical standards would need to be established for new functions that can accommodate to e-Navigation with the priority given to the e-Navigation communication infrastructure, e-Navigation SW and services, and e-Navigation system technology which are key to the realization of the Navigation.

Korean shipbuilding and marine equipment industries will be able to cope with high value-added market in shipbuilding and offshore ICT sector by examining the cases of overseas research carefully, taking domestic situations into consideration, setting the course of research and preparing the technical standards and addressing them in international meetings, and on the basis of that, will be able to expand their capability to take the lead in setting the international standards. Standardization is required for maritime communication and ship equipment network, marine information processing, electronic navigational chart and marine system. Particularly, standardization of communication infrastructure, which forms the basis of e-Navigation service and system, needs to be strengthened. To ensure effective response to national disasters such as a marine disaster, etc., by using the e-Navigation infrastructure, the interlinking and interoperability standards would need to be developed for the e-Navigation communication infrastructure and maritime communication system related to national disasters.

(3) Rising demand for safety, health and comfortable environment

There has been a rising demand for maritime safety technology that can prevent marine pollution caused by accidents on ships or offshore structures and consequent tremendous damage to marine environment as shown in oil spill accidents in Korea, including the Hebei Spirit oil spills, Chinese Bohai Bay oil spills, and oil spills in the Gulf of Mexico. There is a growing demand for risk-based survivability assessment for avoiding potential hazards to ships and offshore plants and for prevention and monitoring of failures and accidents. For ultra-high-priced products, such as ships and offshore plants, which are more costly to maintain, researches have been conducted increasingly on the techniques for maintenance. Demand has risen for welfare services for young crews in this internet era. To support that, it would be necessary to develop technology for content creation and welfare support services. With the rising income of the public, there is a growing desire across the society for marine leisure activities in Korea. Many local governments located on the coastline are planning the creation of marinas.

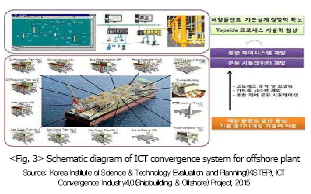

(4) Offshore plant ICT convergence system

To evaluate the risks related to offshore plant, continuous operation and possibility of failure, it is necessary to evaluate the risks based on Hazard Identification(HAZID) and Hazard and Operability(HAZOP), etc., acquire reliability data of equipment, build database, and secure the data mining technology. The 3D CAD information, process and production planning and material logistics plan for offshore plants are carried out by single independent project management technique. Therefore, the technology is required which enables evaluation and production simulation according to changes in constructions and construction methods. Large shipyards are mulling over the research and development for ICT convergence control and safety system that forms the computer network and drives actuators according to software logic technology in order to put the drilling or refining processes in place based on sensing of temperature, pressure, flow rate, etc. in offshore plants such as semi-rig and FPSO.

2. Trend of technology development by major companies

(1) Trend of overseas companies

Core element technologies, such as futuristic state-of-art vessels of new type and CIMS for shipbuilding applications, etc. are being jointly developed through collaboration among the industry, universities, and research institutes, amid the changes in the ship and marine technology development policy called ‘Challenge 21 Plan’, along with automation for construction of high-quality general vessels. Offshore plant clients such as Shell, BP, Petrobras, Exxon, and Total, and offshore plant-related companies such as McDermott and Technip are proceeding with standardization in connection with the OREDA(Offshore and Onshore Reliability Data), Database, API regulations, etc., thus building the technology barriers.

The EU has the unrivalled leading position in the technology for high value-added vessels such as luxury passenger ships and high-speed vessels, and is constantly focusing on the development of IT convergence-based equipment including the ship design programs and e-navigation, etc., to further strengthen competitiveness of shipbuilding industry. China is seeking to strengthen its capability in the construction of low-end vessels such as bulk carriers, the segment where the country has cost competitiveness based on low wages. Broadband mobile satellite communication technology is currently under development because narrow-band mobile satellite communication, including Inmarsat, Iridium, and Thuraya, has limitations in the delivery of broadband convergence service such as voice and internet. At present, the core systems are dominated by manufacturers of the United States and Europe.

In the United States, NITIA is taking the lead in the development of radio navigation radar technology and ITU-R international standards that conform to new technical standards. Meanwhile, OFCOM in the U.K. is focusing on developing the technologies to improve radar performance. In addition, the Japanese Ministry of Internal Affairs and Communications is considered to be most active in adopting new technology standards of WRC2007 to garner larger share of international market. The National Oceanic and Atmospheric Administration(NOAA) of the United States has developed the PORTS(Physical Oceanographic Real-Time System) to provide real-time weather information vital for port safety. Currently, the PORTS is being operated in 21 ports in the United States. And Norway is developing the VMP(Virtual Marine Platform), a platform for collection and processing of maritime data, management of information and services.

Moreover, the standards for e-Navigation have been developed, led by the IMO, to provide useful and accurate information to the vessels and observation posts monitoring the navigation of vessels to ensure maritime safety and environmental protection. As a result, global standardization and technology development have gathered pace for wireless communication equipment and communication protocols, ship workstation equipment, and land support systems, etc. In the meantime, new IT convergence equipment have been developed and rolled out in the marine leisure segment which has seen the IT convergence spreading the most quickly and easily.

(2) Trend of domestic companies

Korea is attempting to develop necessary basic technologies such as basic design of offshore plants, risk analysis and collision interference check, but the technology still remains at the inchoate stage. Research and technology development have been under way in the fields of marine mobile/satellite communication technology and radio navigation radar technology, but most core technologies are dominated by manufacturers of the United States and European.

Daewoo Shipbuilding & Marine Engineering(DSME) developed a state-of-art CMMS(Computerized Maintenance Management System) in 2010, which enabled integrated management of all facilities and materials on ships, preventive maintenance and status monitoring through preliminary inspection. Joint use of research equipments owned by universities and research institutes is supported for software SMEs(Small Medium Enterprises) through the Korea Technology & Information Promotion Agency for SMEs under the Small and Medium Business Administration to increase utilization of equipment and strengthen technology competitiveness of SMEs. Samsung Heavy Industries(SHI) has developed and commercialized SAMS(Ship Administration & Management System) which can monitor, analyze and manage the status of ship operation not only on the ship but also from the land-based locations. Ship and Area Network(SAN) technology, which connects all ship devices with networks combing the optimal wired and wireless technologies, has been developed through joint research between Electronics and Telecommunications Research Institute and Hyundai Heavy Industries(HHI) and adopted as an international standard, paving the way for providing next-generation additional services in the period ahead. The Marine Electronics Industry Promotion Association(MEIPA) entered into MOU(Memorandum of Understanding) with NMEA in the United States to build a domestic certification system for equipment conforming to NMEA 2000, an international standard for shipboard network(IEC 611623), thus laying a cornerstone for the industrialization of standard ship network equipment/marine leisure equipment and support for technology development.

3. Current status of technology infrastructure

The Ministry of Science, ICT and Future Planning held a ceremony to declare the ‘K-ICT Shipbuilding and Marine Convergence’ at the head office of Hyundai Heavy Industries(HHI) in Ulsan on December 6, 2016 in a bid to help strengthen the competitiveness of shipbuilding & offshore industry through ICT convergence. The Ministry is proceeding with ‘ICT Convergence Industry4.0S’(ship building & offshore industry) project(2016-2020) based on the needs of the shipbuilding industry and put forth future course of its policies for systematic implementation of the project in order to strengthen cooperation for ICT convergence in shipbuilding industry.

The Ministry presented 3 major strategies and 7 major tasks, such as shipbuilding/offshore industry-IT convergence foundation-laying, development of smart ship shipyard service technology, and promotion of win-win cooperation ecosystem, etc., under the banner, ‘Take a giant leap forward to transform the country into a shipbuilding/offshore industry-IT convergence powerhouse by 2023’ based on the ‘K-ICT shipbuilding/offshore industry-IT promotion plan’ mapped out jointly by concerned ministries in October 2016 subsequently to the measure envisioned to beef up the competitiveness of shipbuilding industry. The Ministry plans to launch the Shipbuilding & Marine ICT Creative Convergence Center in Ulsan Information Industry Promotion Agency to build the infrastructure for SW performance verification, expand technological capability and underpin the development of professional manpower in connection with the shipbuilding/offshore industry-IT convergence foundation-laying. For the smart ship shipyard service technology development, the Ministry plans to secure high value-added shipbuilding & offshore industry-ICT convergence products and services based on development of application technology such as intelligent ship management system MRO platform and IoT(Internet of Things) big data platform for shipbuilding & offshore industry. Moreover, the Ministry plans to operate the shipbuilding & offshore industry-ICT convergence council to help stimulate the win-win cooperation ecosystem and create the ecosystem for co-growth of large and small-to-medium companies by providing support for commercialization in the field of shipyard services delivered by SMEs.

4. Analysis of patent trend

(1) Trend of patent application by year

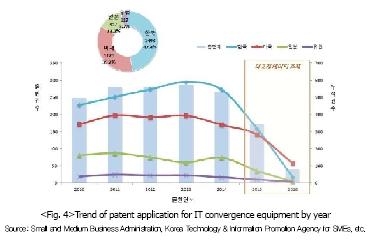

The number of patent applications, filed for IT convergence equipment between 2010 and 2016, showed a repetitive rise and fall, suggesting that the technologies related to IT convergence equipment were developed vigorously. By country, number of patent applications filed in Korea exhibited a rise-and-fall tendency while the decrease in patent application was not significant. The United States and Japan also showed a rise-and-fall tendency, while Europe showed that the number of patent applications was maintained at a certain level. However, the number of populations was not high. By the percentage of applications by country, Korea comprised 47.4% of all patent applications, the highest worldwide, followed by the United States with 35.7%, Japan with 13.2% and Europe with 3.7%, suggesting that Korea is developing the IT convergence equipment technologies the most actively.

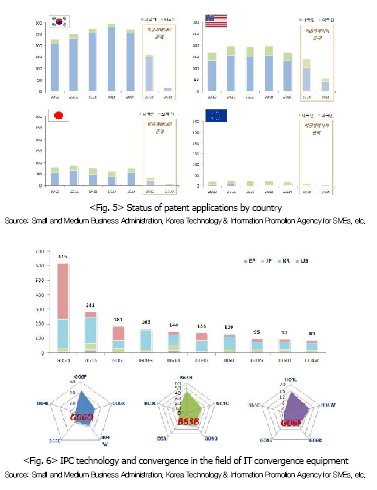

(2) Status of patent application by country

The number of patent applications filed in Korea has increased constantly over the last decade. The proportion of patent applications filed by foreigners remains very low compared to that of patent applications filed by Koreans nationwide. In the United States, the number of patent application has shown a downward trend since 2014. The proportion of patent applications filed by the U.S. citizens is high, while the proportion of patent applications filed by foreigners has reached about 25%, suggesting that multinational investment has been made actively in IT convergence equipment. The number of applications filed in Japan is showing a rise-and-fall trend, and the percentage of applications filed by Japanese citizens remains high. In Europe, the number of patent applications is not high, but the proportion of patent applications filed by foreigners is very high.

(3) Analysis of input technology and convergence

615 patent applications were filed in G06Q technology field, the highest, followed by 281 patent applications in B63B technology field and 181 patent applications in G06F technology field, as found on the basis of the IPC(International Patent Classification) Code in connection with the input technology for IT convergence equipment sector. In addition, there were 163 patent applications in G08G, 144 patent applications in B63H, 136 patent applications in G08B, 129 patent applications in H04L, 93 patent applications in H04B, and 83 patent applications in H04W, which suggests that various types of technologies have been converged in IT convergence equipment sector. Along with that, the TCT(Technology Cycle Time) was found to be 10.5 years in the B63B technology field, the longest, while the TCT in G06Q and H04W technology fields turned out to be 4 years, the shortest, for concerned IPC.

- 이전글중소·중견기업 기술로드맵 2017~2019(IT 융복합 기자재)-국문 19.05.29

- 다음글윈드리버, 디바이스 자동화에서 자율운영 시스템으로의 혁신 가속화하는 에지 플랫폼 신제품 출시 19.05.24